The Price of Admission

Uncertainty isn’t an anomaly in investing – it’s the price of admission. And 2025 has been one of the noisiest years in recent memory. Despite tariffs, geopolitical tension, and policy uncertainty, the S&P 500 returned +14.8% through September 30th, 20252.

Artificial intelligence (AI) continues to be the dominant theme in the market. In 2026, the AI hyperscalers (Alphabet, Amazon, Meta, Microsoft, and Oracle) are projected to spend $432 billion on capital expenditures4. Spend is expected to increase 81% from 2024’s year-end estimate of $239 billion4.

The ripple effects have been significant. Companies who focus on supplying the critical components, infrastructure, and power to the datacenters have been huge beneficiaries.

It’s too early to tell whether the return on investment will justify the spending that is taking place today. Investors must remain discerning as valuations – and expectations – have risen. As Warren Buffett once cautioned in his 1993 shareholder letter, with complex investments it can be hard to tell whether you’re buying the next Barbie or Pet Rock5.

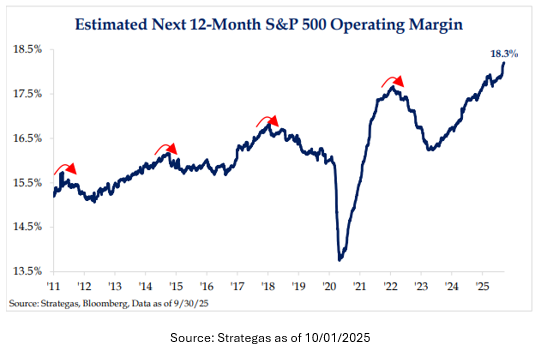

While AI has captured much of investors’ attention, the market’s underlying strength has been grounded in resilient earnings growth. Companies are doing more with less by leveraging technology to boost productivity and margins. The improving operating margin profile of the S&P 500 provides one explanation for why the S&P 500 trades at a higher valuation today than it has in the past.

Additionally, the underlying composition – or the companies within the S&P 500 – look much different than prior decades. In the 1980’s, nearly two-thirds of the S&P 500 consisted of asset-heavy manufacturing companies6. Today, close to half the index is made up of asset-light businesses built around data and intellectual property6.

Spending on AI has been immense, but adoption and application is still in its infancy. We believe AI could provide multi-year tailwinds to productivity and margins. US companies have already proven to be adept at managing through crisis as we spoke about in our previous newsletter (“Shifting Gears”). It’s exciting to imagine what the future may hold with AI tools at their disposal.

The path forward likely won’t be linear – it rarely is. In the short run, several factors support optimism:

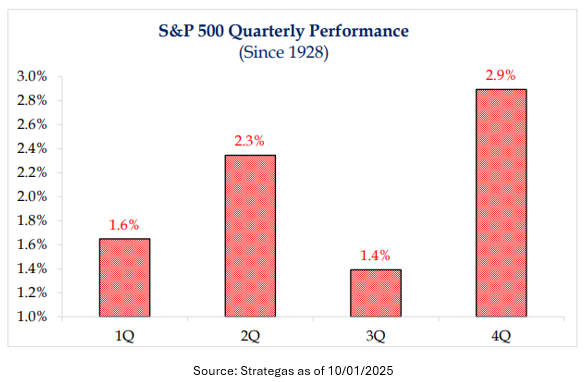

• Seasonality. The 4th quarter historically delivers strong returns3.

• Interest rates. Additional cuts are expected from the Fed7.

• Capital markets. IPOs and M&A activity are picking up3.

Looking further out, we see more durable forces at play:

• Deregulation. Reducing friction supports economic growth.

• Policy clarity. The worst of policy and tariff uncertainty is likely behind us.

• AI innovation. Transformative potential remains early in its lifecycle.

As French writer Jean-Baptiste Alphonse Karr once wrote, “The more things change, the more they stay the same” 8. The world is evolving quickly, and it’s easy to be distracted by noise – especially amid a technological revolution. Yet change creates opportunity.

In a market that is increasingly dominated by short-term thinking and gratification, our advantage lies in time arbitrage – the discipline to think long term when others may not.

We appreciate your continued support, confidence, and trust.

Bryce Goldbach, CFA®

Portfolio Manager & Wealth Strategist

10/2/2025

Citations

[1] www.cartoonstock.com David Sipress. February 4, 2022.

[2] www.ycharts.com “S&P 500 Index Return (1975-2025) as of 09/30/2025”

[3] www.strategas.com “Quarterly Review in Charts Wed. Oct. 1, 2025.”

[4] www.goldmansachs.com “Why We Are Not in a Bubble Yet as of 10/08/2025.”

[5] https://www.berkshirehathaway.com/letters/1993.html Warren Buffett. March 1, 1994.

[6] www.theirrelevantinvestor.com Animal Spirits: Why Retail is Outperforming as of 10/01/2025”

[7] https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html “CME FedWatch.”

[8] www.the100yearlifestyle.com “The More Things Change, the More They Stay the Same as of 10/17/2021.”

Disclosures

Past performance is not indicative of future results. The material above has been provided for informational purposes only and is not intended as legal or investment advice or a recommendation of any particular security or strategy. The investment strategy and themes discussed herein may be unsuitable for investors depending on their specific investment objectives and financial situation. Information obtained from third-party sources is believed to be reliable though its accuracy is not guaranteed, and Asio Capital makes no representation or warranty as to the accuracy or completeness of the information

Past performance is not indicative of future results. The material above has been provided for informational purposes only and is not intended as legal or investment advice or a recommendation of any particular security or strategy. The investment strategy and themes discussed herein may be unsuitable for investors depending on their specific investment objectives and financial situation. Information obtained from third-party sources is believed to be reliable though its accuracy is not guaranteed, and Asio Capital makes no representation or warranty as to the accuracy or completeness of the information

Disclosures

Past performance is not indicative of future results. The material above has been provided for informational purposes only and is not intended as legal or investment advice or a recommendation of any particular security or strategy. The investment strategy and themes discussed herein may be unsuitable for investors depending on their specific investment objectives and financial situation. Information obtained from third-party sources is believed to be reliable though its accuracy is not guaranteed, and Asio Capital makes no representation or warranty as to the accuracy or completeness of the information